Asian stocks started a new month on a cautious note on Monday, with the Bank of Japan’s surprise policy easing sparking some buying but further signs of economic weakness in China and a fall in oil prices keeping investors on guard. The greenback continued to benefit from the growing monetary policy divergence between the U.S. and its counterparts in Europe and Asia while bonds, especially investment grade debt, received a boost after Japan’s surprise decision to introduce negative interest rates last week. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS edged up 0.2 percent, after losing 8 percent in January. Australia and Japan .N225 leading regional markets with gains of more than 1 percent each, while Chinese stocks .SSEC.CSI300 slipped in early trade. “In the short term, the surprise move by Japan will be a catalyst for global equities but it only underlines the weakness of the global economy and we need to see some strong economics data for a sustainable rally,” said Cliff Tan, head of global markets research with Bank of Tokyo-Mitsubishi UFJ. Monday’s batch of economic data from China added to worries about the health of the world’s second-largest economy and only increased calls for more policy easing from China. Activity in China’s manufacturing sector contracted at its fastest pace in almost three-and-a-half years in January, missing market expectations, while growth in the services sector slowed, official surveys showed on Monday. “As deflationary pressures remain high, further reserve requirement cuts are still needed to support the slowing economy and permanently inject liquidity into the market,” ANZ strategists wrote in a note. They expect a total of 200 basis points of cuts this year with a 50 basis points cut coming in the first quarter. “In fact, refraining from further easing could risk an even weaker economy, which will then intensify depreciation expectation and capital outflows.” The Shanghai Composite Index .SSEC eased 0.8 percent in early trade, while the CSI300 index .CSI300 of the largest listed companies in Shanghai and Shenzhen fell 0.6 percent. January was the worst monthly performance for the Shanghai market since the 2008 crisis with more than a 10 percent loss. The Bank of Japan said it would charge for a portion of bank reserves parked with the institution, an aggressive policy pioneered by the European Central Bank (ECB). Earlier in January, the ECB indicated it could cut rates further in March. “The fact that both the BOJ and the ECB suddenly showed additional easing stance after the markets’ rout suggests policymakers in Japan and Europe share concerns and take actions,” Masafumi Yamamoto, chief currency strategist at Mizuho Securities, said. In contrast, the U.S. Federal Reserve has so far stuck to the script that it will gradually raise interest rates this year even though bets have been pared back with Federal Fund rate futures <0#FF:> pricing in barely one hike this year. Elsewhere, fixed income markets cheered a fresh round of policy easing from a major global central bank with investment grade debt in Asia ending a torrid January on a high note. In government debt, the rate-sensitive U.S. two-year yield fell to a three-month low of 0.766 percent US2YT=RR on Friday before bouncing somewhat to 0.779 percent. The U.S. 10-year debt yield fell to 1.93 percent US10YT=RR, edging near a double-bottom around 1.90 percent made in August-October, also helped by speculation Japanese investors will go after U.S. bonds as local bond yields plunge. On Monday the 10-year Japanese government bond yield hit a record low of 0.050 percent JP10YTN=JBTC while the two-year yield hit a record minus 0.100 percent JP2YTN=JBTC. Negative interest rates pressured the yen, which traded briefly at 121.38 to the dollar JPY=, near six-week low of 121.70 touched on Friday. The euro was steadier at $ 1.08440 EUR=. Oil prices fell, with international benchmark Brent LCOc1 sliding 1.8 percent to $ 35.35 per barrel. Still, oil has bounced more than 30 percent from a 12-year low hit less than two weeks ago, taking some pressure off reeling global equity markets but that bounce is proving to be fleeting. A 19-commodity Thomson Reuters/Core Commodity CRB Index .TRJCRB, a global benchmark for commodities edged higher and up more than 8 percent from a 13-year low hit in late January. (Additional reporting by Hideyuki Sano in TOKYO; Editing by Kim Coghill)

Sunday, January 31, 2016

GLOBAL MARKETS-Asia shares edge up, oil wobbles as markets await China surveys – Reuters

The Apophis Syndrome, Or The Oil Price Dilemma – Seeking Alpha

Click to enlarge

Click to enlarge

The Apophis syndrome.

Apophis, (Egyptian mythology) is an evil snake-god of darkness, who tries to devour the sun every night. But Ra, the sun god, destroys him every morning at dawn.

It is the name of an asteroid (325 m) formerly thought to be on a collision course with Earth in 2029.

However, a possibility remained that during the 2029 close encounter with Earth, Apophis would pass through a gravitational keyhole, a small region no more than about 800 m (~0.5 mile) wide that would set up a future impact exactly seven years later, on April 13, 2036. The odds of an impact on 12 April 2068 as calculated by the JPL Sentry risk table had increased to 3.9 in a million (1 in 256,000).

On the first day of January 1, 2014, the brent crude oil price closed at approximately $ 108 per barrel. About twenty five months later the brent crude oil price closed at $ 36 per barrel or approximately 67% lower and hit a record low on January 20, 2016 at $ 27.10.

The main subject, is whether or not this total oil price collapse makes sense? 2/3 of the price of oil has gone up in smoke, in just two-year period. What can really justify such a disaster?

Click to enlarge

Click to enlarge

The primary reason that has been commonly presented to explain this collapse, time and time again, is that the US shale producers increased oil production from 5.48 MBOPD in 2010 to 8.66 MBOPD in 2014, and now, well over 9 MBOPD. Placing the USA as the third oil producer in the World and creating a new imbalance in the oil demand/supply which triggered an unprecedented oil glut.

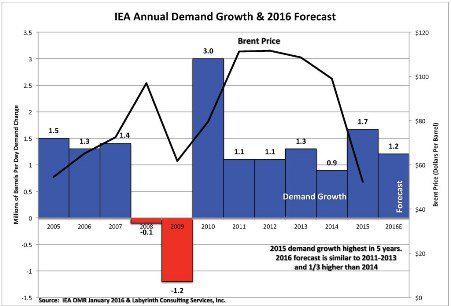

Other reasons commonly advanced, are a slowdown of the China economy with a decelerating demand of 1.1%, and increase in production by Iraq and soon Iran.

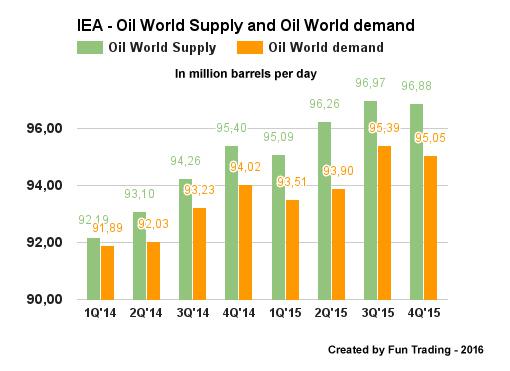

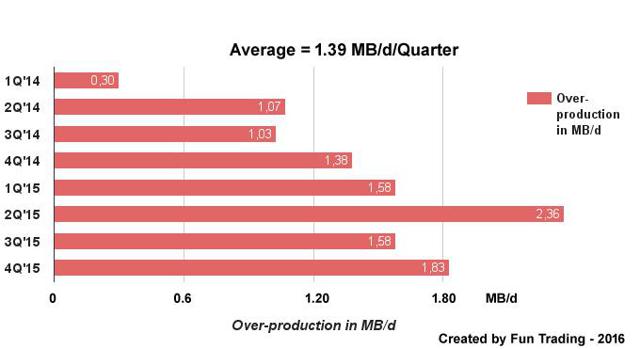

According to the International Energy Agency (“IEA”), the world has been over-producing in 2014 and 2015 at an average of 1.39 MB/d per quarter.

Click to enlarge

Click to enlarge

IEA is not expecting the market to balance in 2016 either, however, can we trust this forecast?

In this recent article from M. Arthur Berman on Oilprice,

Finally, the Oil and Gas Journal has provided an analysis and forecast of world liquids production that is more optimistic than either EIA or IEA.

It appears that this oversupply is not an overwhelming hurdle, and could be quite easily corrected, if the oil producers sit together and work out a deal. It is what common business sense is telling them to achieve urgently, if they want to avoid a collapse of the entire market, right?

Let’s assume OPEC cuts production by 5% and Russia follows. We will have well over 2 MBOPD immediate cut, turning the glut to a shortage, and triggering a huge short covering.

We often forget that oil is a political tool used to fight an ideological war based on different alliances, in spite of the fundamental need that requires a demand/supply equilibrium, players will eventually move on the opposite direction.

In fact and to illustrate my comment above, the oil market rallied for four sessions after a renewed call from OPEC for joint efforts with rival producers to cut supply, which was supported by Russia, something that it has refused to do for the past 15 years. It is hard to imagine that OPEC and Russia will accept to reduce production, however, we are approaching an apparent consensus, obviously.

Looking deeper at the situation, I realize that the US shale revolution and its impact on production, was not really the reason why Saudi Arabia decided to increase its oil production and manipulate the oil price to profit in a long-term.

This new strategy was not without a painful price to pay. Saudi Arabia closed its 2015 budget with a budget deficit of $ 87 billion, and will be forced to cut public spending by a whopping $ 227 billion. Because Saudi Arabia oil production account for 73% of the Country’s revenue, the recent drop in oil price will lower revenue by 71% to $ 115 billion.

Then, why King Salman continues to play a game that he is not about to win apparently?

The answer is a long story, deeply embedded into the Middle East time fabric and two different visions of Islam.

Saudi Arabia on the one hand and Iran on the other hand. Between the Sunni-led Saudi Arabia — with a minority of about 10-15% Shiites — and the Iranian-led Shiite block, backed by Russia. Hard to know where the USA are standing in this status quo?

Early January, religious feuds ignited between Iran and Saudi Arabia, following the execution of the Saudi Shiite cleric Nimr al-Nimr, causing a diplomatic row as well.

Furthermore, the return of Iran to the global oil markets threatens the Saudi Arabia’s leadership among OPEC, which is not a positive in the future negotiations about any supply cut agreement.

However, we started to notice some cracks appearing early January when the sanctions against Iran were lifted and triggered another oil sell off.

On January 19, 2016, Oman announced, it would cut production by up to 10 percent in order to stabilize the market. And, despite what Al Naimi’s said in December, “Only Allah knows the price“, suggesting that Saudi Arabia will not intervene to influence oil prices. But, oil at $ 27.10, a few days ago, may have sent a red flashing light and we may be about to see a strategic change.

Conclusion:

It is a fight between two opposite sides, as Apophis against Ra. This battle will never end, and has been ongoing for decades. It is not simply about oil fundamental really, unless the situation turns totally atypical.

IEA is not getting the story straight, in my opinion, and keeps on “projecting” production set totally arbitrarily, based on a continuous flow of data that runs smoothly.

The difference is that this flow a data is controlled by a group of individuals, who can change strategy at will, whereas demand cannot be altered on such a short notice.

The only potential event that can change the direction of the oil prices significantly, is an imminent financial hiccup that could trigger a global financial crash, that I called the Apophis syndrome.

It was evident that oil prices dropping below $ 30 recently, were affecting the general market, in a way that was quite unusual. Maybe Saudi Arabia, Iran and Russia understood that it was time to stop playing with explosive and start to get serious about controlling production to a more sustainable level?

We will know soon if the last recent warning was loud enough to create an agreement amongst the producers.

Analysts: Global deal to cut oil production unlikely – USA TODAY

Low oil prices have meant cheap gasoline for consumers but paying for oil producing countries.(Photo: SAUL LOEB, AFP/Getty Images)

Conflicting reports last week that renewed anticipation of global oil production cuts, then quickly squelched it, left in doubt the prospects of crude prices that have plunged 70% the past 18 months and rocked the global economy.

News that OPEC and Russia could meet in February to trim output pushed up West Texas Intermediate 8% until reports shot down the possibility, causing crude to give back much of the advance. Still, speculation of a deal left the U.S. benchmark up 4% the past two trading days at $ 33.62 a barrel, capping its second straight weekly gain.

So is a global oil agreement likely?

Don't bank on it.

"It is a lot of noise," says Eric Lee, oil analyst at Citigroup. "From my perspective, I think it's not very likely."

Lee and other analysts say there's too much bad blood among Saudi Arabia, Russia and other OPEC nations for a deal to be forged and not nearly enough financial benefit.

With a slim-to-none chance of a pact to curb oil production, crude's price is poised to hover near current levels or fall further before last year’s modest output cuts by U.S. and other producers have a bigger impact in the second half of 2016, analysts say. Lee expects oil prices to climb above $ 50 a barrel by late 2016.

That should leave gasoline below $ 2 a gallon until the U.S. summer driving season nudges it to about $ 2.40, says Tom Kloza, chief global analyst of the Oil Price Information Service.

Crude's plunge handed consumers a $ 100 billion windfall at the pump last year but hammered business investment, oil company profits and stocks. Economists are starting to wonder if it's a net benefit or drag for the economy.

The price skid was set off by weak global demand and record production, fueled largely by massive U.S. shale output. Worldwide oil supplies exceed demand by about 1.5 million barrels a day.

Despite Saudi Arabia’s historic role as swing producer, it adamantly maintained output levels as oil prices sagged in summer 2014. The Saudis, analysts say, are weary of fellow OPEC members violating production-cut deals to hold market share and are determined to let prices tumble to drive higher-cost U,S. producers out of business.

But oil’s recent slide below $ 30 intensified the pain for OPEC countries and Russia, which depend on oil revenue to finance their budgets, says Oppenheimer analyst Fadel Gheit. Russian news agency TASS reported Thursday the likelihood of a February meeting between OPEC and Russia was "very high."But OPEC delegates told Bloomberg there were no plans to meet.

Last year, Saudi Arabia proposed that global producers slice output 5%, a move that Gheit says would boost prices 50% to 100%. Yet Russia and Saudi Arabia are “archrivals” in oil and Mideast politics, Kloza says.

""I don't think that Saudi Arabia trusts Russia to hold to any agreement,” Lee says. “It never has.”

There are other obstacles. Russia would face challenges shutting old wells and starting them again, Kloza says. Iran is eager to take advantage of an agreement with the U.S. that lifts its sanctions, allowing it to increase output by additional 300,000 barrels a day. Iraq is itching to boost production after scaling back amid recent wars.

And although falling crude prices have left a big hole in Saudi Arabia’s budget, it has about $ 600 billion in reserves and can afford to be patient, Gheit says, especially with prices expected to partially rebound. Also, U.S. shale producers have proved more resilient than Saudi Arabia expected, but Lee expects a wave of bankruptcies this year.

"Why should the Saudis stop now if (their strategy) is starting to really work?" he says.

Read or Share this story: http://usat.ly/1SRPV5i

February Is the Longest Month for Central Bank Watchers – Bloomberg

The shortest month may prove the longest one for financial markets this year.

February lacks a single scheduled opportunity for the Federal Reserve, European Central Bank or Bank of Japan to reset monetary policy, in part because some policy makers decided last year to meet less frequently.

That leaves investors to navigate any new threat to the global economy on their own after central bankers helped to limit losses in the worst January for stocks since 2009.

Equities recovered from a deeper sell-off as the Fed hinted it may be slower to raise interest rates, the ECB signaled more stimulus is on the way and the Bank of Japan embraced negative rates for the first time.

Unless central banks spring surprise action this month, investors are prey to any further slide in commodities or ructions emanating from China, beset by deteriorating growth and a lack of clarity on policy makers' intentions.

"February is like an air pocket as no major central bank is scheduled to hold a meeting," said Kazuhiko Ogata, chief Japan economist at Credit Agricole SA in Tokyo. "That creates a risk of further wild ups-and-downs in global markets."

MSCI World Index

Central bankers may be less unhappy about the break, which is also shared by the Bank of Canada and Swiss National Bank. The Bank of England still convenes its officials this Thursday. The People's Bank of China doesn't have scheduled policy meetings, leaving it out as a wild card — though its actions have sometimes roiled global stock markets rather than helped them.

For one, the gap will give them more time to ascertain just how their economies will be affected by the recent slide in stocks and commodities, as well as China's economic slowdown. Between now and March, if market convulsions subside, focus could turn to underlying signs of stability in the top economies. Fed officials said last Wednesday they are "closely monitoring global economic and financial developments."

Leaving investors to their own devices for a few weeks could also be in order given that some central bankers themselves have questioned the potency of even more monetary stimulus. They also argue that it's not their job to prop up asset markets — even if they have the reputation for doing so.

Scrapping Meetings

Policy makers themselves are the reason for the fewer gatherings this month. The ECB last year decided to meet every six weeks rather than monthly, while the BOJ cut its gatherings to eight from 14. That brought both closer in line with the Fed, whose Open Market Committee meets eight times this year.

The reduction in meetings was in part so that the ECB and BOJ could act more transparently by publishing more reviews of their economies and decision-making. ECB President Mario Draghi also said last April that the previous "frequency of our meetings leads the public and the market to expect action."

At ING Bank NV, international economist Rob Carnell said that markets may also find a reason to calm down as central banks sit out a month.

"When you're approaching central bank meetings, their proximity is frequently a source of volatility and uncertainty, but if there's no imminent meeting you don't get quite so worked up," he said. "Markets can get confused over direction, so look for a steer — but I'd like to hope things settle down and they aren't as hung up on whatever the data tends to be and what it means."

Dallas Fed head Kaplan says Fed will be “patient” amid global turmoil – Modern Readers

"It should be saying to people (that) we are going to take some time here to understand what is going on," said Kaplan on Friday, marking the first time a Fed mover-and-shaker has talked publicly since the central bank decided Wednesday not to announce another rate hike. He believes that it is paramount on the Fed's part that it chose not to use the word "balanced" in its language when describing global risks to the U.S. economy.

The Fed announced its first rate hike in a decade in December 2015, and comments from Fed policymakers at the time suggested four more rate increases would follow in 2016. But the fallow state of several world economies, including those of China, Japan, and some European nations, have made investors doubtful that the Fed would follow through. As such, they now expect that the central bank will only raise rates once in 2016.

According to Kaplan, global concerns and plummeting oil prices made him expect headwinds in the U.S. economy. He also criticized recent Chinese policy decisions to navigate its economy's choppy seas as "clumsy" in Friday's statements. "When you put all that together I think there is good reason to be patient (and) take more time to assess the impact on the U.S. economy," said the Dallas Fed president, who does not have an official vote in policy decisions, but takes part in all Fed deliberations.

Referring to China's "clumsy" moves, Kaplan talked about how the country made use of "circuit breakers" to put trading to a screech while stock markets was especially volatile earlier in the month, but ultimately failed to stanch the financial bleeding caused by selloffs. "It's unusual for them in my experience to appear as clumsy as they were over the last six weeks and that clumsiness has jarred people," he remarked.

In his comments, Kaplan did not mention any details on the potential timing of the Fed's next rate hike.

Check out these holiday deals!:

Saturday, January 30, 2016

Fed will be patient on US policy given global risks: Kaplan – Reuters

The Federal Reserve will be patient as it decides how trouble overseas could hit the U.S. economy, a Fed policymaker said in an interview, suggesting the central bank will be slower to raise interest rates this year. Dallas Fed President Robert Kaplan said on Friday it was “significant” that the Fed decided this week to no longer describe the risks to the U.S. economy as being “balanced,” a term that meant officials were comfortable with their view of the outlook. “It should be saying to people (that) we are going to take some time here to understand what is going on,” Kaplan told Reuters in the first public comments by a top policymaker since the central bank’s decision on Wednesday to hold rates steady. The Fed raised rates for the first time in a decade in December, at which time policymakers signaled four further hikes would come in 2016. But since then economic weakness in China, Europe and Japan have prompted deep skepticism among investors, who now see only one hike this year. Kaplan’s comments seem to support that cautious view. Global equities and oil prices plunged through most of January and Kaplan said he expected overseas challenges to affect the U.S. economy. He characterized as “clumsy” China’s policy moves over the last six weeks to counter turmoil in Chinese financial markets. “When you put all that together I think there is good reason to be patient (and) take more time to assess the impact on the U.S. economy,” said Kaplan, who does not have a formal vote on Fed policy this year but who takes part in all deliberations. Kaplan declined to say how quickly he expects the Fed to lift interest rates this year. But he said a tightening of global financial conditions, including relatively steeper lending rates for investment grade companies, was getting his attention. The Fed’s next policy meeting is in March, when policymakers will also release new forecasts on how steep the path of interest rates will be this year. “It’s not going to be any steeper,” said Kaplan, who took the reins at the Dallas Fed in September. While the Fed has embarked on what it hopes will be a gradual tightening path, other major central banks are headed in the opposite direction with stimulus that has boosted the dollar’s value and helped keep U.S. inflation well below the Fed’s 2 percent target. The Bank of Japan on Friday made the shock decision to cut rates below zero, prompting some to warn of “currency wars” that do little for global growth. Kaplan, who in the 1990s ran Goldman Sachs’ Asian banking operations out of Tokyo, said the move “will have some effect clearly on the dollar and we are very mindful of that,” adding that Japan is “doing what it needs to do.” He said Chinese officials are still learning how to manage their whip-sawing financial markets. The country used so-called “circuit breakers” to halt trading when its stock markets were plunging this month, but scrapped the tool after it appeared to exacerbate the selloff. “It’s unusual for them in my experience to appear as clumsy as they were over the last six weeks and that clumsiness has jarred people,” Kaplan said, adding that China was unlikely to “melt down” in part because of its substantial dollar reserves. Wall Street’s biggest banks still see three Fed rate hikes this year, though many others now see the Fed getting overtaken by a global economic downturn. The Fed’s statement “signaled that it is now hostage to international developments and markets,” said Mohamed El-Erian, the chief economic advisor at Allianz, who expects two hikes this year and possibly none at all if economic and financial market conditions worsen. (Reporting by Jonathan Spicer and Jason Lange in New York; Editing by Chizu Nomiyama)

Xerox workers worried for jobs – Gates-Chili Post

ROCHESTER — The formal announcement Friday by Xerox about its split into two businesses has left many people asking what is in story for the future, as well as its 6,500 local employees.

Concern was widespread among those individuals who live in downtown Rochester, as well as Xerox employees themselves.

Kathy Belli is a Xerox employee said there is always a fear of layoffs. Xerox is Rochester’s fourth largest employer with 6,575 employees.

“This news doesn’t change my fear," Belli said. "I mean, there’s no security anywhere.”

Xerox CEO Ursula Burns confirmed that the company will be split into a business focused on document technology and another on business processing.

Burns, who was named CEO in 2009, said that jobs could be lost.

“Our workforce will shrink very likely,” said Burns, “but it does every year as it becomes possible to do more with less.”

U.S. Sen. Chuck Schumer, D-New York, in the past has stepped in to fight to keep jobs in New York, most recently after a reorganization at Kraft that threatened closure of a plant in Avon last year.

Schumer said he was initially worried after learning the news, but after reaching out to Burns, he said he was reassured that Xerox remains committed to Rochester.

“She assured me that this split wouldn’t impact current job levels, or Xerox’s footprint in Rochester,” said Schumer. “There’s no plan to pack up and leave.”

Schumer said that if Xerox ever needed help to continue operating in Rochester, he would fight to protect local workers.

“I’ll do anything to keep these jobs in Rochester,” said Schumer. “I was successful when Hickey Freeman had its financial problems and take-over, and Bausch and Lomb had it twice, and not only keeping the jobs here, but actually growing them at those two companies, and I would try to do the very same for Xerox.

“These jobs are good paying jobs, they’re very important to Rochester and to Webster, and to the whole Rochester/Finger Lakes area…. and I’m gonna watch this like a hawk. In business you’ll never know what happens, but I will watch it very, very carefully and hopefully we’ll have the same success we had at Bausch and Lomb, and Hickey Freeman.”

Bob Duffy of the Greater Rochester Chamber of Commerce and Monroe County Executive Cheryl Dinolfo pledge support. They promised to do their best to keep Xerox in Rochester, and assist employees who may be affected by the company’s split.

Burns said she expects the separation to take place by the end of the year. It is also almost certain that the Xerox name will remain with one of the two companies.

Greece’s international lenders to start bailout review on Monday – Reuters

Greece’s official lenders will start a review on Monday of what progress the country has made in implementing the economic reforms agreed under its third bailout, a necessary step towards debt relief talks, a finance ministry official said on Saturday. Greece’s international lenders are the International Monetary Fund and the euro zone bailout fund. The reforms that Greece has to implement in exchange for loans are also reviewed by the European Central Bank and the European Commission. “The first phase will last a few days as there will be a break at the end of next week, after which the institutions will return to conclude the negotiations,” the official said, declining to be named. Athens is keen for a speedy completion of the review, which was expected to begin late last year, and hopes a positive outcome will help boost economic confidence and liquidity. To secure a positive result from the review Athens needs to pass legislation on pension reforms to render its social security system viable, set up a new privatization fund and come up with measures to attain primary budget surpluses for 2016-2018. A successful conclusion of the performance review will open the way for debt relief talks. The head of the bailout fund, the European Stability Mechanism (ESM), has ruled out a haircut for Greece’s debt but extending debt maturities and deferring interest are options that could be used to make it more manageable. French Finance Minister Michel Sapin told Sunday’s Kathimerini newspaper debt relief talks must start soon to help restore Greece’s financial stability. “France’s view is that the sooner the first review is completed, the faster we will be able to tackle the issue of debt sustainability and this will be better for everyone – for Greece as well as the entire euro zone,” Sapin told the paper. (Reporting by George Georgiopoulos; Editing by Greg Mahlich)

Fed’s Williams says sees ‘smidgen’ slower rate hikes – Business Insider

Thomson ReutersJohn Williams, president of the Federal Reserve Bank of San Francisco, speaks during an interview in San Francisco, California By Ann Saphir

SAN FRANCISCO (Reuters) – The Federal Reserve probably needs to keep U.S. interest rates lower for longer given headwinds from weak global economic growth, a stronger dollar and an unexpectedly sustained drop in oil prices, a top Fed official suggested on Friday.

San Francisco Federal Reserve Bank President John Williams told reporters he now sees slightly slower growth, slightly higher unemployment, and about a tenth of a percent lower inflation this year than he had expected in December, when the Fed raised rates for the first time in nearly a decade.

At the time, officials at the Fed, the U.S. central bank, had as a group expected about four further rate hikes this year, and Williams had said that was in line with his own expectation.

That view appears to have changed, after investor worries about a global slowdown and weakness in China sent equities and oil prices plunging through most of January. Meanwhile the dollar has strengthened, pushing down on U.S. inflation, which is running well below the Fed’s 2-percent target.

“Standard monetary policy strategy says a little less inflation, maybe a little less growth … argue for just a smidgen slower process of normalizing rates,” Williams said.

“We got a little stronger dollar, some mixed data on the economy, some weakness in (fourth-quarter U.S. GDP growth), all of those coming together kind of tell me that we probably need a little bit more monetary accommodation this year than I was thinking in the middle of December.”

Earlier this week Williams was in Washington, where he and other Fed policymakers decided to leave benchmark rates unchanged and to acknowledge that they were closely watching global financial markets.

Williams said that over the past several months nothing had fundamentally changed in his view of China’s growth path, and that even the Bank of Japan’s surprise move to negative interest rates on Friday had not changed his baseline forecast for the U.S. economy.

Further, his scenario of what’s most likely for the U.S. economy, his “modal” forecast, remains fundamentally unchanged for 2016 and 2017, he said.

He has previously forecast the U.S. economy will grow at about 2 percent to 2.25 percent, inflation will begin to return to the Fed’s 2-percent target over the next couple of years, and the unemployment rate, now at 5 percent, will also fall.

“The thing that has changed is that commodity prices keep coming down,” he said.

(Reporting by Ann Saphir; Editing by James Dalgleish)

Read the original article on Reuters. Copyright 2016. Follow Reuters on Twitter.

More from Reuters:

- Sri Lanka ex-leader’s son arrested by financial crimes police

- Obama to make first visit to U.S. mosque next week

- Ex-general, CIA chief David Petraeus to receive no further punishment

- Support dips for Irish PM’s party ahead of election: poll

- France says to wind down Central African Republic force by year-end

Why Facebook is banning gun sales from site – Christian Science Monitor

Facebook is banning the sale of private guns on its social network, and the Instagram photo-sharing service, adding it to a list of already prohibited items including, marijuana, pharmaceuticals, and illegal drugs for sale.

The ban will apply to private, person-to-person sales of guns, and will not affect licensed gun dealers, gun clubs, or retailers who advertise on the site. The move is intended to cut down the transaction of unlicensed guns, the company announced on Friday.

"We will remove reported posts that explicitly indicate a specific attempt to evade or help others evade the law," the company said in a statement Wednesday. "For example, we will remove reported posts where the potential buyer or seller indicates they will not conduct a background check or are willing to sell across state lines without a licensed firearms dealer."

Facebook first took steps to ban gun advertising to minors in 2014, in response to gun control advocates who long voiced their concerns that the Internet allows anonymous parties to sell guns without background checks, and that criminals, minors, and other prohibited gun purchasers can easily obtain firearms from these sellers.

Facebook said it has more than 1 billion active monthly users worldwide.

New York Attorney General, Eric T. Schneiderman, alongside other advocates, pushed Facebook to restrict illegal transactions, and prompted Facebook to the delete posts from users selling illegal guns, including those who offered weapons for sale without background checks.

Gun control advocates cited a 2013 Third Way study that said "thousands of guns, including so-called assault weapons, are for sale online and that many prospective buyers were shopping online specifically to avoid background checks," the Washington Post reported. The study focused on on Armslist.com, a popular classified site that facilitates private sales of firearms and ammunition based on location.

In announcing the measures, Facebook’s Monika Bickert, head of Global Policy Management, wrote that its new policy would be a compromise between freedom of speech and safety. "This is one of many areas where we face a difficult challenge balancing individuals' desire to express themselves on our services and recognizing that this speech may have consequences elsewhere," she said in a blog post.

Facebook has not directly been involved in gun sales, but has served as a forum for gun sales, including, person-to-person sales. The company was not e-commerce site, and until recently, it was not possible to complete financial transactions on its social networks.

But last year, the company introduced new services that allows peer-to-peer payments through Messenger service, as well as a project that directs users to local businesses and services, according to New York Times.

Ms. Bickert said that Facebook's progress towards e-commerce necessitated changes in its policy.

“Over the last two years, more and more people have been using Facebook to discover products and to buy and sell things to one another. We are continuing to develop, test, and launch new products to make this experience even better for people and are updating our regulated goods policies to reflect this evolution,” said Bickert.

New York's attorney Schneiderman welcomed the move saying that it is "another positive step toward our shared goal of stopping illegal online gun sales once and for all."

Gun control advocacy groups, including Everytown for Gun Safety and Moms Demand Action for Gun Sense, also praised the decision.

“We’re gratified that our continuous conversation with Facebook over the course of the last two years has culminated in the company prohibiting all unlicensed gun sales arranged on its platforms,” said John Feinblatt, the president of Everytown for Gun Safety, according to NBC news. “Our undercover investigations have shown that criminals are active in the online market for guns, where unlicensed sellers can offer guns with no federal background check required.”

Schumer vows to work to protect Xerox jobs in Rochester – SCNow

ALBANY, N.Y. (AP) — Sen. Charles Schumer says he was initially alarmed by news that Xerox plans to split into two different publicly traded companies, but that he’s been assured by the company’s current CEO that the change won’t impact thousands of jobs in Rochester.

The New York Democrat tells The Associated Press that he spoke with Xerox Chairwoman and CEO Ursula Burns on Friday. He says Burns says the company’s reorganization is not expected to lead to any reductions in positions at the company’s document technology business based in Rochester.

Subscription Required

An online service is needed to view this article in its entirety. You need an online service to view this article in its entirety.

Login

Choose an online service.

The following services are print only and offer no digital access

Need an account? Create one now.

You must login to view the full content on this page.

© 2016 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

Thank you for reading 15 free articles on our site. You can come back at the end of your 30-day period for another 15 free articles, or you can purchase a subscription and continue to enjoy valuable local news and information. If you need help, please contact our office at 843-317-NEWS. You need an online service to view this article in its entirety.

Login

Choose an online service.

The following services are print only and offer no digital access

Need an account? Create one now.

Xerox moves to split itself in two following pressure from Carl Icahn – Washington Post

Xerox, the 109-year-old tech giant synonymous with the photocopier, announced Friday that it is giving up on its strategy to combine services with its traditional office machine business and would instead split itself into two companies.

One company would consist of the products of Xerox's proud past: an $ 11 billion publicly traded firm that sells copiers, printers and scanners. The other would be made up of what many expected to be its future: a $ 7 billion company that manages call centers, collects tolls and performs other back-office services for government agencies and corporations.

The split follows a similar move by another member of the old-guard tech elite, Hewlett-Packard, which said last year that it would separate its desktop computers and inkjet printer business from servers, networking and cloud computing.

Xerox's breakup comes amid pressure from Carl Icahn, a billionaire activist investor who is Xerox's second-largest shareholder. He has been rattling for change for months.

"We believe the separation will greatly enhance value for [Xerox] shareholders," Icahn said in one of a series of tweets about the company's announcement Friday. As part of the shake-up, Icahn won the ability to appoint three members of the board of the services company.

The split unravels one of the chief accomplishments of longtime Xerox CEO Ursula Burns, who orchestrated the purchase of Affiliated Computer Services (ACS) in 2010, and it calls into question her future at the firm.

"What I wanted our board and our management team and me to do was to think about what the best path for the company is going forward, not what the best role is for me," Burns said in an interview with CNBC on Friday.

[With Xerox split, the future for Ursula Burns is unclear]

Xerox has been struggling for years.

Originally based in Rochester, N.Y., it was once best known for inventing new machines — from the photocopier to the laser printer. But each new innovation was quickly replicated by competitors, and Xerox struggled to keep up, industry analysts said. Today, it has about 11 percent of the printing and copying market that it helped create, according to Gartner Research.

"They were relying on technological innovation, and people kept catching up with them," said Ken Weilerstein, an analyst at Gartner Research.

Now Xerox is facing perhaps a more existential threat: environmentally conscious workers and their penny-pinching bosses who want to use less paper, not more, and have relegated the office copier and printer to an afterthought.

Burns pushed to acquire ACS for $ 6 billion in a bid to diversify Xerox's business. But harmony between the companies was never evident, industry analysts said, and Wall Street became impatient as the company's prospects continued to falter.

Xerox's net income fell to $ 488 million last year from more than $ 1 billion in 2014. Its stock has tumbled 28 percent over the past year. (It was up nearly 5 percent Friday after the announcement of the split.)

The split of the company will leave whoever takes control of Xerox's legacy printing business a daunting challenge — the same one Burns was trying to fix with the acquisition of ACS, industry analysts said. "They are still very reliant on printing, and it is not clear what they're going to do about that," Weilerstein said.

Just as unclear is what happens to Burns, who started at Xerox as an engineering intern in 1980. She became the first black woman to become CEO of a Fortune 500 firm in 2009 and has been recognized several times by Forbes as one of the most powerful women in the United States.

Carl Langsenkamp, a spokesman for Xerox, said in an emailed statement that Burns will discuss her recommendations for the future leadership of the companies with the board "at the appropriate time," noting that "Ursula is — first and foremost — focused on delivering on our 2016 plan and executing the separation and strategic transformation we announced today."

If she were to leave the company, it is possible there would be no remaining African American women running a Fortune 500 company.

"It's a shame," said Steve Mader, a vice chairman at Korn Ferry, an executive search firm. "There's just more talent than that out there."

Some governance experts doubt Burns will remain with Xerox, particularly since the decision to split the company was a reversal of a strategy she had pursued.

"I'd be surprised if she stayed," said Charles Elson, director of the John L. Weinberg Center for Corporate Governance at the University of Delaware. "It'd be unusual."

But Mader said Burns still has a good shot.

"She knows the business inside and out," he said. "She took a big gutsy risk, and it didn't work. That doesn't mean she isn't capable of running the original core business."

Renae Merle covers white collar crime and Wall Street for The Washington Post.

Jena McGregor writes a daily column analyzing leadership in the news for the Washington Post's On Leadership section.

Friday, January 29, 2016

Facebook Moves to Ban Private Gun Sales on Its Site and Instagram – New York Times

Facebook is banning private sales of guns on its flagship social network and its Instagram photo-sharing service, a move meant to clamp down on unlicensed gun transactions.

Facebook already prohibits people from offering marijuana, pharmaceuticals and illegal drugs for sale, and the company said on Friday that it was updating its policy to include guns. The ban applies to private, person-to-person sales of guns. Licensed gun dealers and gun clubs can still maintain Facebook pages and post on Instagram.

Although Facebook was not directly involved in gun sales, it has served as a forum for gun sales to be negotiated, without people having to undergo background checks. The social network, with 1.6 billion monthly visitors, had become one of the world's largest marketplaces for guns and was increasingly evolving into an e-commerce site where it could facilitate transactions of goods.

The ban thrusts Facebook into the center of another major societal debate. Discussions over gun control have flared anew after the mass shootings last year in San Bernardino, Calif., and a community college in Oregon, among others. In January, President Obama gave a speech promising to tighten enforcement of laws governing unlicensed gun sales. In response, some individual sellers said they would turn to sites like Facebook, which allowed them to freely advertise guns for sale.

Facebook said it would rely on its vast network of users to report any violations of the new rules, and would remove any post that violated the policy. Beyond that, the company said it could ban users or severely limit the ways they post on Facebook, depending on the type and severity of past violations. If the company believed someone's life was in danger, Facebook would work with law enforcement on the situation.

Facebook will also rely on user reports of private gun sales that occur between members via Facebook Messenger, the company's private messaging service. Facebook does not scan the content of those messages.

"Over the last two years, more and more people have been using Facebook to discover products and to buy and sell things to one another," Monika Bickert, Facebook's head of product policy, said in a statement. "We are continuing to develop, test and launch new products to make this experience even better for people and are updating our regulated goods policies to reflect this evolution."

New York's attorney general, Eric T. Schneiderman, who has pressed for restrictions on illegal gun sales on Facebook and other sites, praised the company's move.

"Today's announcement is another positive step toward our shared goal of stopping illegal online gun sales once and for all," he said in a statement on Friday.

Facebook plays host to scores of online groups that cater to gun enthusiasts, with members posting pictures and details about an individual gun, or a gun they might be looking to buy. Many of the groups are private, meaning that Facebook users may need to be approved by an administrator before they can see or write posts.

Unlike professional gun sellers, hobbyists who sell or trade a few guns a year are not typically required to be licensed by the federal government. Some, like Scott Schmoke of Florida, say that Facebook helps them sell just a handful of weapons a year. Mr. Schmoke said in an interview this month that he always insisted on meeting potential buyers face-to-face, to feel them out.

"I go to a secure location, and I say, 'Can I see your driver's license? Do you have a concealed-weapons permit?' " Mr. Schmoke said. If he gets a bad feeling, he does not sell, he said.

But as an unlicensed seller, Mr. Schmoke is under no obligation to perform any kind of background check. Federal authorities have expressed worries that the Internet has fueled the sale of guns to felons and others who might normally be blocked from buying firearms.

Facebook has taken some steps to regulate gun sales over the years. In 2014, it said it would limit gun sales on its site and on Instagram, including by shielding minors from Facebook pages that advertised guns for sale.

But since then, Facebook has been inching toward facilitating e-commerce transactions. In December, the company introduced a project that directs users to local businesses and services that are well-reviewed on Facebook. Facebook can also store users' credit card information. And in recent months, Facebook made it possible to send peer-to-peer payments through Messenger.

Facebook's progression toward on-site payments underscored the need to update the company's content policy, a Facebook spokeswoman said.

The company has also been pushed by gun safety groups including Everytown for Gun Safety, an umbrella group that united the efforts of two separate organizations of mayors and mothers to promote gun safety. Shannon Watts, the founder of Moms Demand Action for Gun Sense in America, one of those two advocacy groups, said she met with senior Facebook officials repeatedly over the last two years.

Everytown for Gun Safety presented Facebook with research connecting unlicensed gun sales on the site to gun violence. For example, Ms. Watts said, in December 2014, an Ohio man, Brian Harleman, shot and wounded his ex-girlfriend and killed her 10-year-old daughter before killing himself. Although prohibited from buying firearms because of a felony conviction, he was able to buy the weapon in an unlicensed sale on Facebook.

"We were saying, 'Please stop the unfettered access to guns on Facebook,' " Ms. Watts, a mother of five in Colorado, said in an interview.

Because of Facebook's tremendous influence, she said, its decision to ban person-to-person sales of guns will have ripple effects on gun policy nationwide.

"What they're doing is sending such an incredibly strong, sentinel signal to the world that America is working in the right direction on guns," she said. "For them to take a stand and do the right thing gives cover to other businesses to do the right thing."