The Apophis syndrome.

Apophis, (Egyptian mythology) is an evil snake-god of darkness, who tries to devour the sun every night. But Ra, the sun god, destroys him every morning at dawn.

It is the name of an asteroid (325 m) formerly thought to be on a collision course with Earth in 2029.

However, a possibility remained that during the 2029 close encounter with Earth, Apophis would pass through a gravitational keyhole, a small region no more than about 800 m (~0.5 mile) wide that would set up a future impact exactly seven years later, on April 13, 2036. The odds of an impact on 12 April 2068 as calculated by the JPL Sentry risk table had increased to 3.9 in a million (1 in 256,000).

On the first day of January 1, 2014, the brent crude oil price closed at approximately $ 108 per barrel. About twenty five months later the brent crude oil price closed at $ 36 per barrel or approximately 67% lower and hit a record low on January 20, 2016 at $ 27.10.

The main subject, is whether or not this total oil price collapse makes sense? 2/3 of the price of oil has gone up in smoke, in just two-year period. What can really justify such a disaster?

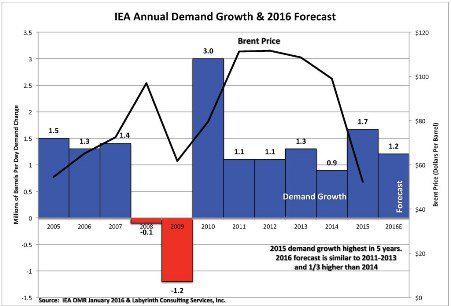

The primary reason that has been commonly presented to explain this collapse, time and time again, is that the US shale producers increased oil production from 5.48 MBOPD in 2010 to 8.66 MBOPD in 2014, and now, well over 9 MBOPD. Placing the USA as the third oil producer in the World and creating a new imbalance in the oil demand/supply which triggered an unprecedented oil glut.

Other reasons commonly advanced, are a slowdown of the China economy with a decelerating demand of 1.1%, and increase in production by Iraq and soon Iran.

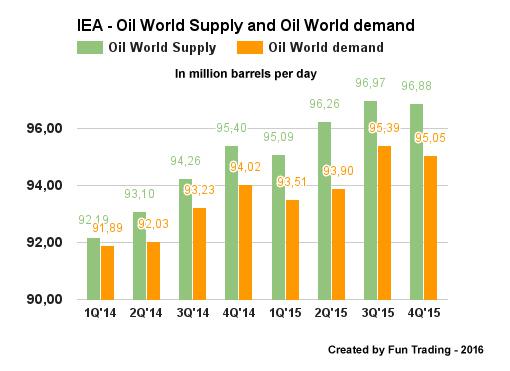

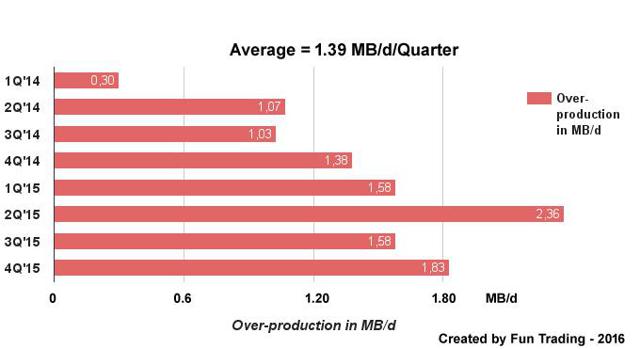

According to the International Energy Agency (“IEA”), the world has been over-producing in 2014 and 2015 at an average of 1.39 MB/d per quarter.

IEA is not expecting the market to balance in 2016 either, however, can we trust this forecast?

In this recent article from M. Arthur Berman on Oilprice,

Finally, the Oil and Gas Journal has provided an analysis and forecast of world liquids production that is more optimistic than either EIA or IEA.

It appears that this oversupply is not an overwhelming hurdle, and could be quite easily corrected, if the oil producers sit together and work out a deal. It is what common business sense is telling them to achieve urgently, if they want to avoid a collapse of the entire market, right?

Let’s assume OPEC cuts production by 5% and Russia follows. We will have well over 2 MBOPD immediate cut, turning the glut to a shortage, and triggering a huge short covering.

We often forget that oil is a political tool used to fight an ideological war based on different alliances, in spite of the fundamental need that requires a demand/supply equilibrium, players will eventually move on the opposite direction.

In fact and to illustrate my comment above, the oil market rallied for four sessions after a renewed call from OPEC for joint efforts with rival producers to cut supply, which was supported by Russia, something that it has refused to do for the past 15 years. It is hard to imagine that OPEC and Russia will accept to reduce production, however, we are approaching an apparent consensus, obviously.

Looking deeper at the situation, I realize that the US shale revolution and its impact on production, was not really the reason why Saudi Arabia decided to increase its oil production and manipulate the oil price to profit in a long-term.

This new strategy was not without a painful price to pay. Saudi Arabia closed its 2015 budget with a budget deficit of $ 87 billion, and will be forced to cut public spending by a whopping $ 227 billion. Because Saudi Arabia oil production account for 73% of the Country’s revenue, the recent drop in oil price will lower revenue by 71% to $ 115 billion.

Then, why King Salman continues to play a game that he is not about to win apparently?

The answer is a long story, deeply embedded into the Middle East time fabric and two different visions of Islam.

Saudi Arabia on the one hand and Iran on the other hand. Between the Sunni-led Saudi Arabia — with a minority of about 10-15% Shiites — and the Iranian-led Shiite block, backed by Russia. Hard to know where the USA are standing in this status quo?

Early January, religious feuds ignited between Iran and Saudi Arabia, following the execution of the Saudi Shiite cleric Nimr al-Nimr, causing a diplomatic row as well.

Furthermore, the return of Iran to the global oil markets threatens the Saudi Arabia’s leadership among OPEC, which is not a positive in the future negotiations about any supply cut agreement.

However, we started to notice some cracks appearing early January when the sanctions against Iran were lifted and triggered another oil sell off.

On January 19, 2016, Oman announced, it would cut production by up to 10 percent in order to stabilize the market. And, despite what Al Naimi’s said in December, “Only Allah knows the price“, suggesting that Saudi Arabia will not intervene to influence oil prices. But, oil at $ 27.10, a few days ago, may have sent a red flashing light and we may be about to see a strategic change.

Conclusion:

It is a fight between two opposite sides, as Apophis against Ra. This battle will never end, and has been ongoing for decades. It is not simply about oil fundamental really, unless the situation turns totally atypical.

IEA is not getting the story straight, in my opinion, and keeps on “projecting” production set totally arbitrarily, based on a continuous flow of data that runs smoothly.

The difference is that this flow a data is controlled by a group of individuals, who can change strategy at will, whereas demand cannot be altered on such a short notice.

The only potential event that can change the direction of the oil prices significantly, is an imminent financial hiccup that could trigger a global financial crash, that I called the Apophis syndrome.

It was evident that oil prices dropping below $ 30 recently, were affecting the general market, in a way that was quite unusual. Maybe Saudi Arabia, Iran and Russia understood that it was time to stop playing with explosive and start to get serious about controlling production to a more sustainable level?

We will know soon if the last recent warning was loud enough to create an agreement amongst the producers.

No comments:

Post a Comment