I have been a Coke (NYSE:KO) shareholder since late 2008, and have been very happy with my results thus far. I also recognize that my timing (investing during the financial crisis), was very advantageous. During that time Coca-Cola’s shares have grown to represent the largest single stake in my portfolio. I like to take a look at each of my holdings at least twice per year, to see what has changed in outlook for each company. Coca-Cola is among my Long Term Holdings. Recently, I have also written about my Coca-Cola holdings as part of articles on Business Models and the characteristics shared by our portfolio companies.

Coca-Cola’s shares have been especially popular with investors for the last few decades, but past performance is no indication of future results. As the ubiquitous cola giant, Coca-Cola is in fact the real thing. As the owner of many of the world’s best known brands, Coke sells more than 3,500 products in more than over 200 countries around the world. Coke has been in business for 129 years and is headquartered in Atlanta, Georgia. The company also has major investments in Monster Beverage Corporation (NASDAQ:MNST) and several bottler operations. The company also recently sold a massive position in Keurig Green Mountain when was the company was taken private a few months ago.

The Struggles

Chief among Coke’s struggles is growth. When a company has a $ 200 billion market cap, it can be tough to grow organically. Coke has tried to purchase growth in recent years. Two of the best examples are the company’s investments in Monster Beverage Corporation and Keurig Green Mountain mentioned above. The December 2015 deal to sell Keurig Green Mountain to a group of European investors for about $ 92 per share, salvaged Coke’s investment in the company. Coke’s $ 2 billion investment was down 43% prior to the deal being announced (based on Keurig Green Mountain’s share price). Fortunately the losses were erased for Coke shareholders, but the experience highlights some of the risks when a company tries to purchase growth.

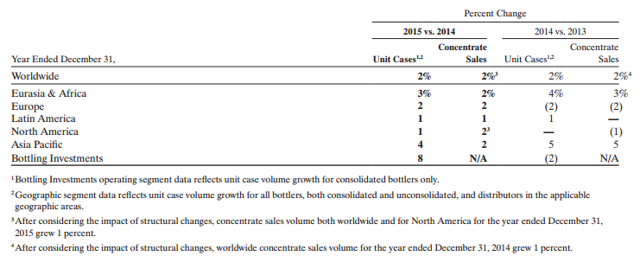

The growth concerns are best demonstrated by the lack of growth in the company’s sales volume over the past several years. Currencies (and as a result earnings) fluctuate, but sales volume can provide a clearer picture. According to the table below (taken from the 2015 annual report), management was able to sell a greater volume of product in 2015 than the prior year. For the previous 2 years, the volume of product sold had actually declined. I have a theory that cola companies today are very much like American cigarette companies were in 1970s, wherein they make good investments while being vilified by the general public, but that’s a discussion for another time. As a Coke shareholder, I am just grateful to see some year over year volume growth again. Another of the company’s recent struggles has come in the form of currency fluctuations. The US dollar has also strengthened substantially over the last couple years, which has had the effect of reducing Coke’s earnings (which are reported in US dollars) on products that are sold internationally.

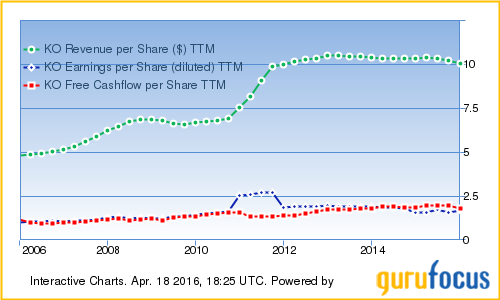

These concerns have also manifested themselves in the company’s revenue, earnings, and cash flow metrics. Take a look at the Gurufocus chart below, and you will see the lack of per share growth in each of these important areas.

The Positives

The struggles above notwithstanding, Coca-Cola has had an amazing track record for providing value to shareholders over the past decades. Even more recently, the company has done a great job of decreasing the outstanding share count and raising dividends annually. Last year the Board of Directors decided to raise the quarterly dividend 8%, marking the 53 consecutive year of annual dividend increases…should bring a smile to even the most dour shareholder. I see the dividend as stable, with a dividend payout ratio of 79%, but some growth will need to materialize if dividends are going to continue to rise.

Management said they believe sales volumes will increase again in 2016. As you may expect the greatest of the volume sales grow (at 4%) took place in the Asia/Pacific region. Across all operating regions, the majority of the volume growth came from non cola segments (think water, juice, tea products). This is generally in keeping with my expectation that growth in the company’s “still products” will continue to outpace cola products in the future. I am glad that management has been focusing more on growing the non cola operations, over the past few years.

Valuation

Coca-Cola is one of those companies whose stock has rarely been cheap, but paying too much for any investment virtually guarantees poor investment returns. Below I will take a look at various valuation metrics and see how Coca-Cola’s current share price stacks up.

I typically discount future earnings in the companies I invest in, in order to help determine what I am willing to pay for the shares. Over the past 8 years, earning per share growth and free cash flow per share growth have averaged 6.41% and 5.95% respectively. While I hope the company can return to higher growth rates, this is a fairly low bar for Coca-Cola and I am believe these levels are maintainable. By discounting those earnings growth rates at a 5% rate, I’ve determined that the current value of the next 20 years of Coca-Cola’s earnings is approximately $ 38 per share. With shares currently selling at a little over $ 46, the company’s shares seem overvalued. (Note, I usually pay a substantial discount to my guesstimate of future earnings.)

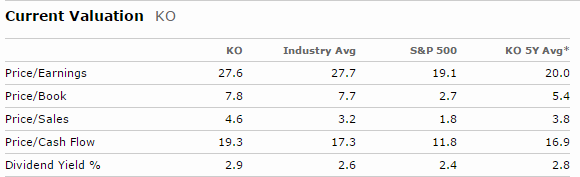

Coca-Cola’s current price-to-earnings ratio of about 27.6, also has shares looking overvalued. From the Morningstar table below you can see that the dividend yield and price-to-cash flow metrics are slightly more than the historical averages, but the price-to-earnings and price-to-sales metrics are much higher than the historical averages. These metrics continue to suggest to me that Coca-Cola’s share price is currently overvalued, even compared to its historical self.

The Gurufocus summary graphs below shows other recent trends for the company. Unfortunately, there has been little growth and cash on hand has declined slightly while the company’s outstanding debt has continued to climb. I would like to see these trends reversed. Even in the current low interest rate environment, debt is only beneficial if you can reinvest the capital in something that earns a higher return. So far Coke’s management has not been able to make good use of the growth in outstanding debt.

Overview

Coke’s share price seems overvalued by several of the valuation metrics and methodologies discussed above. I was glad to see some growth in the volume of products sold, but otherwise I would say the company’s operational performance has been fairly lackluster. That being said, I will analyze the company’s operations in 6 months…and decide if progress is being made. If operational performance continues to be lackluster, I will consider selling this holding.

Many investors seem concerned about governmental regulations (like those in New York), which limit the maximum size of cola containers, or otherwise discourage consumption. Additionally, some jurisdictions are raising taxes on sodas and snack foods. I am not concerned about these health initiatives at all. Such sin taxes have a weak history of influencing consumer habits over the long term. While there may be a short term decline in sales volume, I expect that the higher profit margin which accompany the smaller containers will cover most any shortfall. Plus, I believe that people are creatures of habit and exhibit remarkable brand loyalty. I believe that Coke drinkers will continue to drink Coke’s products, whether by habit or addiction, in spite of higher prices and government intervention.

Last but not least, I need to say something about stock performance. As you can see from the two year chart below, Coca-Cola’s share price has risen substantially over the last 6 months. Given the weak operational performance and metrics which make shares appear overvalued, the increase in stock market price seems unwarranted. I think on a relative basis Coca-Cola may represent a good value to the broader S&P 500, but I believe both are currently overpriced. I have felt Coca-Cola’s stock was overvalued for several years, leading me to quit reinvesting my dividends from the company in 2013. I may buy additional stock if the price falls into the lower $ 30s, but for now I’m looking for opportunities elsewhere.

Disclosure: Long KO. This article is for informational purposes only and should not be considered a recommendation for anyone to buy, sell, or hold any equities. I am not a financial professional. The information above is provided by Yahoo Finance, Morningstar.com, GuruFocus.com, and www.coca-colacompany.com/investors

Disclosure: I am/we are long KO.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment