The Federal Reserve recently released the latest “Financial Accounts of the United States” and I am pleased to inform readers that the U.S. economy is by far the best it has ever been and total household wealth is clearly vastly superior to prior periods. In a nutshell, we’ve done it. We beat back the last recession and generated enormous amounts of new wealth by having asset prices for existing wealth move higher. Who says you need growth in GDP or that real wealth has to be measured in having the goods and services that improve human lives? The financial accounts clearly show that the total household wealth in the United States has grown dramatically and vastly outpaced inflation so long as inflation is measured in other terms.

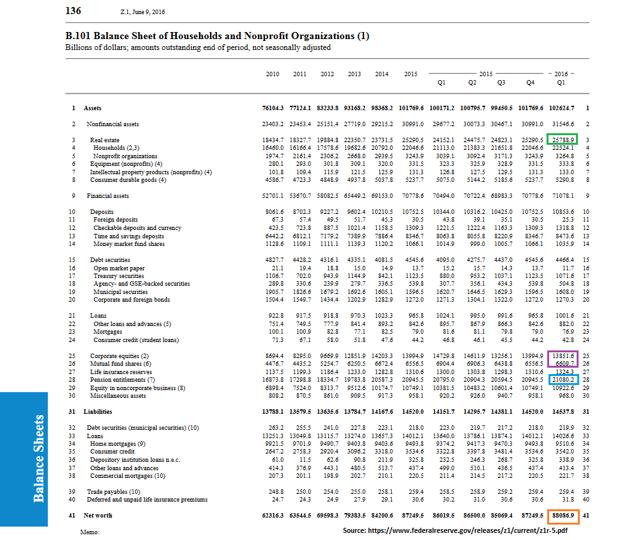

The following image provides the values for the different columns that go into calculating household net worth. I’ve highlighted several of them for further discussion:

Real Estate

The green box demonstrates the total value of real estate. If that were an abundance of new construction, I would agree that we were generating great wealth. When it simply represents an increase in the estimated fair market value of the real estate, I find that less inspiring. In a nutshell this says that some new structures were built and existing homes increased in prices dramatically as the Federal Reserve shoved rates lower and made mortgages more “affordable” on a monthly cash basis. Since income has been largely stagnant, this means someone can afford a higher purchase price on a house since they can afford to carry a larger mortgage at a lower interest rate. The result is higher asset prices and a “gain” in our household net worth.

Of course, if you own a house it still does the same thing it did previously. It protects you from the elements and provides a place to watch Netflix (NASDAQ:NFLX). On paper though, you have a great gain in net worth. You can’t use that gain to buy groceries or pay your utility bills unless you plan to sell the house, but at least owning it keeps you from having to rent.

Purple Box

The purple box shows wealth from owning corporate equity or owning shares in a mutual fund. In this case we’ve seen a great increase in wealth as a result of increasing prices on financial assets. There wasn’t a huge growth in the volume of companies or in the total amounts of goods and services they produce (which would be reflected in GDP) but low interest rates encourage higher equity prices on the TINA (There Is No Alternative) basis. Since bond yields are weak, more investors jump into equity seeking yield.

Blue Box

The blue box is labeled “pension entitlements” but the (7) provides a more complete definition:

“Includes public and private defined benefit and defined contribution pension plans and annuities, including those in IRAs and at life insurance companies. Excludes social security.”

Fortunately no one reading this article has ever known a person that experienced cuts in their defined benefit plan (note the sarcasm). Perhaps you heard about the new laws that provide a way to cut benefits for retired workers. To the extent that it also includes defined contribution plans, it creates another method for tracking gains in the stock and bond markets.

Orange Box

The orange box is the resulting combined net worth of all households and nonprofits. The value is exceptionally high and reflects the enormous gains we’ve made in raising the prices of existing assets rather than building new assets.

Simple Example

Say you live in a city where the hospital has only one ambulance. If you have a heart attack, you may be out of luck. If the hospital can acquire a second ambulance, the community has gained a form of real wealth. That ambulance can provide a service that can save lives. In such a situation, you might feel that your odds of surviving a heart attack had improved.

On the other hand, if the price of ambulances doubled it would do nothing to improve your odds of surviving. Unfortunately, either of these situations would double asset value recorded for ambulances.

Since inflation rates are low over the last several years there is a general theory that the impact of inflation is not material to these measurements. In regard to the prices of many smaller items I would agree. On the other hand, I believe we are seeing substantial asset value inflation. Specifically the value of houses and stocks are becoming highly inflated.

A Better System

It wouldn’t be perfect, but a much better system would look at the net production in areas like physical construction. Inflation in asset values should not be confused with the actual production and maintenance of new wealth.

Conclusion

It would appear we have succeeded in generating record levels of net worth for American households. The net worth is largely tied up in higher prices for assets that already existed, but the numbers aren’t broken down that way. This is a feel good story, so long as you don’t feel like looking deeper.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. This article is prepared solely for publication on Seeking Alpha and any reproduction of it on other sites is unauthorized. Ratings of "outperform" and "underperform" reflect the analyst's estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis.

No comments:

Post a Comment