“Headlines, in a way, are what mislead you because bad news is a headline, and gradual improvement is not.” – Bill Gates

Looking back to the August 2015 time period, the stock market was flirting with the 1,800 level on the S&P 500 and people were panicking. The cry of the day was that the market must know something, and that something has to be really bad. A global recession was looming. Move ahead to the January/February time frame and investors found themselves in exactly the same place. This time the cries were more vocal as the Royal Bank of Scotland’s (NYSE:RBS) mantra at the time was to “sell everything!”, and they were not alone in that view.

I took a different road and stayed with the thought that a bottom was being formed in the market, and viewed the situation as a “growth scare”. Choosing not to follow the notion that a recession was around the next bend. I mentioned at the time that while the declines were real, the reasons may not be.

Don’t get me wrong. There was plenty of uncertainty in the market on these trips to the S&P 1,800 level, plenty of domestic and global worries, and plenty of herd behavior occurring daily.

Fast forward to June 23rd. The S&P closes at 2,113 less than 1% from an all-time high. The Brexit shock hits the stock market one day later, and we heard the same chants again.

It’s always good to stop, step back, look to a reality check. There is little doubt that those who had the fortitude and the ability to follow a stay the course strategy have outperformed all of the other strategies that were employed during these trying times. From extreme cash positioning to hedging, outright net short positions, etc.

However, one week removed from the event, that positive resulting strategy is questioned again by the naysayers, as they defined the markets in collapse just 5 trading days ago. It’s done perhaps in an attempt to justify the wayward ideas that had many investors positioned incorrectly. Hardly anyone was buying into the new high story or the stay invested approach, simply because not many were positioned that way. That mentality has been the byline of this bull market since the beginning.

I borrow this from a recent article penned after the “vote” by a fellow author here on SA, Jeff Miller.

“The most difficult thing for most investors is to “stay the course” in the face of frightening news and incessant recession predictions. It is also the most rewarding.”

Last December when I looked out into 2016, I thought the market would indeed hit new highs. When the catalysts in my thesis failed to materialize early in the year, I conceded that I was indeed wrong.

“My call for higher stock prices in 2016 was based on the trends of crude oil and the USD changing. In just two short weeks, WTI has dropped another 21%. I offer no excuses, it is time to watch, wait and see what develops next.”

The market can and will fool many, and as advertised, it shifted once again. The catalysts I was looking for in January materialized and the S&P vaulted to within 1% of new highs.

The debate heats up now and disregarding the noise that is all around us, it’s time to consider whether the situation in the U.K. will turn out to be a scare similar to others that have come and gone, or a true “Black Swan” that may change the underlying market trend.

Near-term market outlook

After careful review, I have decided to tweak my expectations for the remainder of the year. As with any market outlook, it needs to be tailored to individual specifics before any portfolio changes are enacted. For example, those that are in capital appreciation mode have different objectives that those in capital preservation mode.

A stance for a range bound equity market is reinforced. However, a caveat is now in order, as the odds for a revisit to the low end of the range are increased. In my earlier view, before Brexit, that was off the table in 2016.

The U.K. exit adds to the other issues that investors are mulling over. Slow global growth, central bank actions, unsure earnings picture, and a populist political environment. This uncertainty accentuates the nervousness and fear that was already in place.

By no means does this suggest that I am forecasting the end of the bull market today. My base case now calls for a range bound market, with an upper level of the range to be somewhere in the mid 2,100-2,200 area. That isn’t a radical difference, but the headline risk now increases the odds for bouts of panic selling, tempering the upside.

The downside level of the range becomes very tricky. For now, I will use the 1,925 to 1,970 range for the short term. An intermediate term view complete with detailed support levels are laid out in the technical section of the article. How these issues play out will likely influence the duration of the range bound equity market.

The difficult part of this exercise in planning comes with the earnings factor. If earnings fail to resume growth or economic conditions weaken more than envisioned, critical support levels could eventually fail to hold. On the flip side, a resumption of earnings growth and the market could respond positively. Therefore, it is critical to pay attention to what the earnings picture reveals. Trust me the market will give us a clue as to how they are doing.

As always, I try to keep things in perspective and remain resolute in the idea that there will be plenty of time to react, make the necessary portfolio changes if indeed that need be. Suffice to say, expect volatility to remain high as everyone that has a nose will give their opinion on the ramifications of the U.K. decision.

Remember we are but one week removed from this event. The market may get a bit scarier than we have already seen, as headline risk remains elevated. Similar to what we experienced late in 2015 and again earlier this year. The calls for the market’s demise were wrong then. It’s an investor’s job to determine if these same cries are wrong again or if this is really a game changer. Here is the situation as I see it today.

![]()

Brexit, The aftermath

I have decided to approach this event by analyzing it from both a short-term and a long-term view.

In the short term, there lies a risk that there could be a financial institution that gets in trouble due to the unwinding of positions on the surprise outcome of the vote. Because the unwinding could be rapid and dramatic, the currency market, which is not subject to these large moves, creates a trigger that would spark a domino effect. That is such a complicated situation that not many can predict the outcome either way.

Even if something develops in the coming days, I will stay with my remarks the day after the vote, I don’t believe this will turn into a “Lehman moment”

A week has now passed and the more time that passes indicates that this probability lessens and drops by the wayside. The quick rebound in equity prices may be indicative that the market has already sniffed that out.

In any event, the entire financial system is better capitalized now and better able to withstand a crisis relative to capital positions in 2008. The focus centers on the E.U. banks. U.S. banks are much better capitalized than their E.U. counterparts, but even the E.U. banks have better capital ratios today relative to 2008.

Meanwhile, cries went out that the E.U. was going to collapse, as member after member would follow Britain’s lead and vote to secede. The financial domino would then take effect and on and on. The typical knee jerk reaction.

A recent check on Deutsche Bank’s (NYSE:DB) 7.5% junior subordinated perpetual bonds indicates that doesn’t appear to be the case. If the E.U. is going to implode, these bonds would be getting hit and hit hard. When I checked this week I discovered that last February, when rumors swirled that the European banks were “dead,” these bonds traded around 72. On Tuesday, they were trading around 87 and were actually up during the day. That is a tell that shouldn’t be ignored and throws water on the impending “financial disaster” arguments.

In addition, credit default swaps at the major U.S. banks are also showing no signs of stress. They are at levels that are quite subdued from what they were back in January/February when it was declared that the next financial crisis was upon us because of energy defaults.

Longer term, the Brexit situation is far more complicated, and it is where the bulk of the controversy will come into play. It is estimated that about 44% of U.K. exports go to Europe, so it is an important trading partner. Unwinding from the E.U. will be a lengthy and complicated process that will take years. Both sides have an interest in causing as little economic disruption as possible. I also fully understand the E.U. side won’t let the U.K. off the hook with terms that would be considered friendly, for obvious reasons.

An investor now is faced with the same situation that has been thrown at them in the past. Jump to a conclusion on the dire forecast that comes with a great deal of speculation and an agenda, OR they use common sense and gather all of the facts to make a decision.

Anyone professing they know what will take place in the aftermath of this is dreaming up a scenario and spinning a tale.

Here is just a sampling of what we can look forward to. This example of confusion and differing opinions took place this past Monday, less than a week after the vote

The BBC reports that German Chancellor Angela Merkel said:

“There will be neither informal or formal talks on a British exit until the European Council has received the U.K.’s request for an exit from the European Union.”

After meeting with French President Francois Hollande and Italian Prime Minister Matteo Renzi, Merkel said they were:

“In agreement that Article 50 of the European treaties is very clear, a member state that wishes to leave the European Union has to notify the European Council. There can’t be any further steps until that has happened. Only then will the European Council issue guidelines under which an exit will be negotiated.”

However, according to the Evening Standard, Prime Minster David Cameron said:

“The UK will not trigger formal EU exit talks until a new Prime Minister takes over.” And, Britain was “in no rush to trigger Article 50.”

None of that sounds like a logical, smooth negotiating platform exists as of today, therefore impossible to predict an outcome just yet.

While the present legal structure does not allow the E.U. to force the U.K. into triggering Article 50 and so starting the legal process of exit, the E.U. has stated plainly that they have no interest in starting negotiations until Article 50 (with its 2-year time limit) has been triggered. Should the E.U. get impatient with the U.K. not triggering Article 50, they have numerous levers to pull.

-

They can change the law.

-

Claim the article has already been triggered and dare the U.K. to challenge them in their own courts.

-

Offer E.U. membership to Scotland and Northern Ireland.

-

They can wait for the uncertainty to deal heavy blows to the U.K. economy. Those blows, via layoffs, trade slowdown, and collapsing investment are coming, and the E.U. will be much more stable through that process than the U.K.

I reiterate, there is nothing that is set in stone that is about to take place here.

The fact is, we have never seen this before and there are a myriad of possibilities, endless scenarios that are intertwined in an extremely complicated process. I choose not to adopt any view put forth at this point in time and run with it. That is exactly what the naysayers have done through this bull market and it has gotten them destroyed.

Economy

GDPNow sees Q2 GDP growth of 2.6%, down from the 2.8% forecast one week ago. The new projection factors in last week’s worth of economic data. Presumably, the Brexit is not part of the model’s input, though the thought of a surging dollar might be.

The final revision to the first-quarter GDP numbers showed a revision taking the figure up to 1.1%. No real surprise and it certainly wasn’t a market mover.

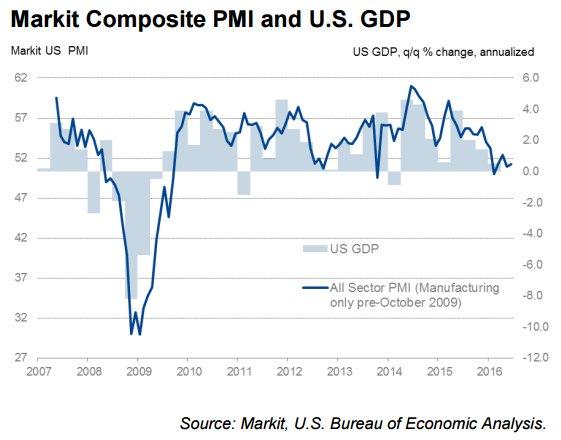

Markit services PMI came in at 51.3 for the month of June. The report indicated that growth was subdued as it rose only fractionally from the 50.9 level recorded in May.

The chart shows the services sector is bouncing along at a level just above the neutral level of 50.

Weakness also remains in the Texas area as the Dallas Fed index remains weak. The general activity business index for the region fell to -18.3 in June. The lone bright spot was that the index of future general business activity bounced back to a positive reading of 2.6 after dipping below zero last month. The index of future company outlook also ticked up, coming in at 7.9. Most indexes for future manufacturing activity pushed further into positive territory in June.

The Richmond Fed indices were negative for growth and activity, negative for profitability of business, but positive for the labor market thanks to the strong wage data in the report. Overall a negative.

A totally different story was brought to us by the most recent Chicago PMI report. The index rose to 56.8 up from 49.3 in May. This region has been one of the weakest. This is only one report, but it was refreshing to see the uptick. It was the highest overall reading in eighteen months and represented an increase of 13+ points from its most recent low of 42.9 during the recent growth scares earlier in the year.

ISM manufacturing results continued the positive news this week. The June PMI registered 53.2 percent, an increase of 1.9 percentage points from the May reading of 51.3 percent. Of the 18 manufacturing industries, 13 are reporting growth in June. Another highlight was the Employment Index, which registered 50.4 percent, an increase of 1.2 percentage points from the May reading of 49.2 percent.

We saw the biggest beat in Consumer Confidence relative to expectations (98.0 vs. 93.1) since September. It must be noted that these results do not reflect the British vote debacle.

Earnings, Crude Oil and the USD

All of these are intertwined. As I ponder all of the info that has been put forth, I am of the belief that looking forward, what Brexit could impact the most is the earnings picture. By that I mean, exactly how much will this shock mean to the improved earnings picture that was reflected in the S&P prior to the U.K. decision. Some companies may be hurt more than others in terms of revenue and earnings, the question is if that does occur and when.

Of course, if one didn’t believe in an improved earnings picture in the second half of this year, they need read no further. For those that have been right and prescribe to a slightly positive outlook, that picture was built on strength remaining in WTI and the USD remaining stable to weak.

So far, those two trends are still in place as positives after the British decision. These two catalysts, which were used to form my positive stance on the market, are now more than ever in the spotlight. Many have taken their eye off of these factors as they choose to react to the headlines before thinking.

Of course, the first reaction is always to extrapolate an event like this to a global recession. That in turn will upset the demand side of the oil equation. While that is yet to be determined, in the short term, I do not see the demand side of the crude oil picture slowing.

On the supply side, this past week’s inventory report from the Department of Energy shows that crude oil inventories fell by 4 million barrels compared to estimates for a decline of just 2.5 million barrels. It was also the sixth straight week that inventory levels declined on a week to week basis.

The technical picture presented last week and the support level at the 50-day moving average remains intact after the British vote.

Source: Bespoke

WTI closed at $ 49.12 on Friday, up $ 1.49 for the week.

The Technical Picture

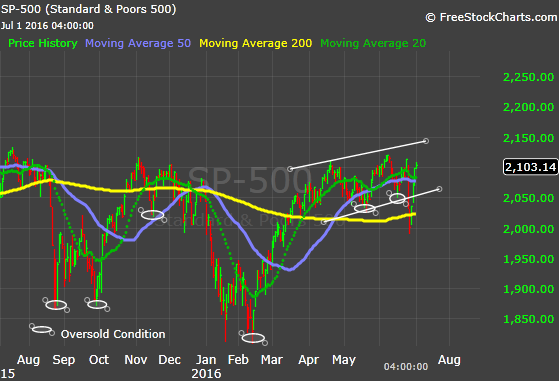

This remains the tie breaker when it comes to formulating, then acting on my short to intermediate term market strategy. Back to Back gap down openings after the shock, took out the S&P 200-day moving average on an intraday basis. So far that has marked the bottom (1991) of the sell off and equated to a 38% retracement of the recent upward move when it closed at 2,000 on Monday, regaining the 200-day trendline.

Looking at the potential downside, given the elevated headline risk, and staying with retracement levels, the 1,973 pivot range would represent 50%, and the 1,929 level is a 62% retracement. The stay the course investor need do little until we start violating these support zones. A reality check shows that S&P 1,929 is only a 9% drop from the highs seen before the shock.

Since we have been involved in a flat trading range, there are multiple levels of both support and resistance. As we have witnessed, once the volatility picks up, these levels are knifed through both on the downside as well as the upside.

Daily chart courtesy of FreeStockCharts.com

This past week saw back to back 90% upside volume days during the rebound. A good sign if you are positive on the market, as these situations mark a turning point in a downtrend. The quick turnaround also brought the index squarely back into the uptrend channel I posted last week.

Before anyone gets too giddy, the S&P has had four uptrends since the May 2015 high of 2,135. All have ended between 2,111 and 2,133. This just may be another one. Having said that it sure has been better to stay on board than waffle around or sell out due to all of the headlines that have been thrown at the market.

Short-term support is at the 2,085 and 2,070 pivot points, with resistance residing at 2,113, then 2,121.

Make no mistake about it, the bears have been presented another opportunity to tell anyone that is positive on the market how wrong they have been.

Clearly, the onus resides with them to now reinforce their predictions of a market demise. Back in August 2015, they had plenty of ammunition to take the market to the lower lows that they predicted. More importantly, the January/February market sell off was a time when the cards were stacked in their favor. With $ 26 oil, global recession, and calls for a market crash, all as prominent headlines. The bulls were reminded daily what was in store for them, and the drop in prices would be breathtaking.

Here is what actually happened. Every negative scenario that was laid out, didn’t materialize.

Now with a shock dropped at their feet, it could be a “third time’s a charm” as the market could be set up for failure as it was in the previous two instances. In their eyes, this is the crack that causes enough damage to end the bull market.

Before I go there, let me just say, it also could be a “three strikes and you are out” story. The prior failures remain in their minds and that alone could cause them to fumble this opportunity as well. The bulls have tirelessly defended their story. It is time for the bears to step up and tell all exactly what has gone wrong with their ill fated narrative.

Monthly chart courtesy of FreeStockCharts.com

Looking at the long-term trendline and my all important 20-month moving average (green line) shows that the trendline is still intact. That trendline has flattened some, just as it did in the month of February. Keeping this in mind suggests that any deep dive from here brings that trend into question. Hence, my remarks about the odds possibly increasing for a revisit to lower prices.

S&P Capital IQ found that shocks normally cause stocks to bottom out in 6 days or less, with a median drop of 5.3%. The 14 shocks since WWII took a median of 14 days to recover all of its losses. Will this time be different? Maybe, but if it isn’t then the market will be close to an all-time high shortly. With Friday’s close of 2,103 on the S&P, that appears to have already played out.

![]()

Individual Stocks and sectors

Individual stock selection becomes even more important now, I can’t stress that enough.

Analysts will now start to have a more reserved approach to companies with international exposure. If one is more conservative and hasn’t abandoned the equity market, a good starting place would be to screen for companies with 100% domestic revenues. Some growth and a dividend yield adds to that attraction.

Consumer Discretionary names like Comcast (NASDAQ:CMCSA), Target (NYSE:TGT), Dollar General (NYSE:DG), and Tractor Supply (NASDAQ:TSCO). The latter was sold off this week on lowered guidance. The long-term story is in place, growth with a small dividend. In the Homebuilding Sector, Lennar (NYSE:LEN) and D.R. Horton (NYSE:DHI) are in this category.

Consumer Staples such as Altria (NYSE:MO), CVS Health Corp. (NYSE:CVS), and ConAgra (NYSE:CAG) are candidates for research. If you still believe crude oil is here to stay, there are plenty of names in the domestic energy patch to choose from. Insurers like a Lincoln National (NYSE:LNC), REITs such as Realty Income Group (NYSE:O), Omega healthcare (NYSE:OHI) and a host of others that are 100% domestic are candidates to review.

Aetna (NYSE:AET), UnitedHealth Group (NYSE:UNH), Quest Diagnostics (NYSE:DGX) are solid companies in the Healthcare sector. Telecom offers AT&T (NYSE:T), CenturyLink (NYSE:CTL) and Verizon(NYSE:VZ) with their above average yields. I believe the valuations in the utility area of the stock market are a bit rich, but they certainly are domestic oriented investments that provide income.

If one is still carrying around the notion that the U.S. banks are not well capitalized, they just need to look at the recent buybacks and dividend increases announced in the sector this week.

A reverse of the domestic strategy that I spoke of would be to take a look at large cap Euro companies. Specifically, those that do a lion’s share of their business internationally. There may be great value there that has been laid at our doorstep. Look at Diageo (NYSE:DEO).

Despite resetting my overall market expectations, I continue to look at growth areas of the market that offer opportunity to me. Healthcare and Biotech, represented by Alexion, (NASDAQ:ALXN), Celgene (NASDAQ:CELG) and Gilead (NASDAQ:GILD), remain at the top of my list. Sure, they have underperformed, but that isn’t because of deteriorating fundamentals. I added more Cisco (NASDAQ:CSCO) this past week with its yield, FCF and balance sheet that look very attractive to me.

Before any of that commentary is extrapolated to start buying indiscriminately, please use some common sense. Those that have stayed invested have little to do here, other than to tweak holdings. These names are offered for those that may wish to round out their portfolios, while attempting to get away from the international stigma that may hamper near-term results elsewhere. I am sure there are plenty of others that fit this description; this is merely a starting point.

These decisions and the timing of them need be made by each individual, based on their investment profile.

The burning questions that need to be wrestled with in the coming days and weeks will be whether the British vote is a political crisis that can morph into a financial crisis. I saw a lot of evidence this week that shows that the likelihood of that is diminishing daily. Others can draw their own conclusions.

Will the hit to the U.K. economy spill over to the eurozone and then here to the U.S. One week removed, that jury is still out. It is way too early to conclude that despite the negative Nancys running around selling their views. The typical headline on Monday;

“It’s rather apparent that we’re primed for extended, perhaps substantial, market weakness.”

One can have a strong opinion on the ramifications of Brexit, and the effect on fundamentals. I see plenty of emotion filled conclusions being formed everywhere. That didn’t help anyone at the lows, instead it has come back to haunt many. Only time will give us some clues as to what happens, but in the meantime we will hear the negative side of the story everywhere.

Fear sells.

At the moment, my analysis suggests that the possibility of a negative impact to our corporate earnings picture should be watched carefully. The results of the British vote will cause a reset to those expectations that “could” inhibit any upward movement in equities, or in fact cause a change in the long-term trend. That depends on a lot of factors and it’s premature to delve into those possibilities now. So its is a potential earnings crisis that I will concentrate on.

This, combined with my earlier remarks, suggests a change in my perspective from a “positive” to a “NEUTRAL” stance on the equity market. There are many factors involved in my decision to make this change. Here is the bottom line. The window for a possible revisit to the sub-1,900 level has reopened and the headline risk has tempered expectations as it adds to the fear mentality that was already in place.

This neutral stance is now in play until I see the first signs of an earnings rebound. We have to also keep in mind with the S&P at Friday’s close of 2,103, it is already reflecting a pickup in earnings going forward. Disappointments on this front won’t be taken lightly, and will be magnified with the European overhang. This played a large part of my decision to now switch to a neutral setting.

So there is no misunderstanding, this stance does not imply that I will be hedging, shorting or employing any other defensive maneuvers now. Covered call writing will play a larger part of my strategy now. I have stated the range that I see now, and it is what I will use for my short to intermediate term strategy.

Those looking for me to turn and enter their negative camp will be disappointed to learn that I’m not ready to make that move based on this event. While I laid out my reservations, one has to understand that the situation just presented to us, may have little to no material effect within the next year or two. Perhaps ever.

Radical action need not be taken now. This will be a very fluid situation, far different from what we have witnessed. Because of that fact, and needless to say, it should be monitored closely.

I choose a view that always leaves the door open for change. Change that could take place in many forms before all is said and done with this issue. In the meantime, we will only be reminded of the NEGATIVES, with not a hint of other options. It’s best to keep an open mind.

Surely, there was a shock that occurred with this vote, no one can ignore that. Yet some immediately declared the bull market dead. A lot of them also declared it dead at S&P 1,800.

The investors that stayed on board now are the only folks in the pilot’s seat. Many options are now available to them; plenty of other market participants can’t say that. There was a reason I remained adamant about my positioning.

I revisit that call for one reason and one reason only, I was trying to put forth the message that panicking and selling prematurely has it consequences.

Can this be the game changer? It is a possibility. I don’t dismiss that entirely. But only after careful consideration should one make a radical portfolio move or draw a conclusion that at the time seems like it “just has to be right”.

The “just had to be right” conclusions were “dead wrong” back at the lows. Just ask the short sellers.

Best of luck to all!

Disclosure: I am/we are long ALXN,CELG,CSCO,TGT.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I may add to my ALXN and CELG positions in the next 72 hours.

No comments:

Post a Comment