On September 5th, the management team at Bayer (OTCPK:BAYZF) (OTCPK:BAYRY) announced its willingness to up its bid for rival Monsanto (NYSE:MON) in an effort to transform its business and aggregate resources in order to meet the challenge of the world’s population growing by another 3 billion people between now and 2050. In this piece, I will dig into the issue and give my own thoughts on the matter.

A look at the deal

Previously, when Bayer first announced its offer to acquire Monsanto in May of this year, I wrote about the topic and gave my own input that if Bayer is confident in its abilities, then Monsanto’s management team would be wise to demand a higher price for the business. The offer at the time stood at $ 122 per share and represented a premium of 26.3% compared to the price that shares were going for on the day before Bayer confirmed it was in talks with Monsanto regarding a potential transaction.

As part of the deal, Monsanto’s shareholders would be paid in all-cash, which is certainly preferable to share-based schemes. Of this, Bayer said that 25% of the deal’s enterprise value would be covered by a rights offering while the rest would require the company to take on additional debt, not only to cover the cost of the $ 122 per share but also, likely, to refinance Monsanto’s existing debt. This deal also included a reverse antitrust breakup fee payable by Bayer to Monsanto in the amount of $ 1.5 billion

Seeing the proposed transaction as inadequate, management at Monsanto declined the offer but said that it would be willing to talk with Bayer. In July, Bayer came out with another offer in the amount of $ 125 per share, representing an increase (for shareholders on an aggregate basis) of $ 1.31 billion. This too, however, was turned down as being inadequate in Monsanto’s eyes.

Now, management at Bayer has upped the ante, stating that it is now willing to offer $ 127.50 per share in exchange for the business. This increase represents a jump of 18.7% compared to the closing share price of Monsanto’s stock on September 5th and represents an aggregate increase for shareholders in the amount of $ 1.09 billion over the July offer and a total increase for them of $ 2.41 billion over their initial offer in May.

Will Monsanto bite?

Personally, I have a hard time believing that Monsanto will agree to this offer and Mr. Market seems to be agreeing with me. Despite the fact that a report was released before the market opened on September 5th wherein it was stated that Bayer would be discussing, on September 14th, whether to bid again for the business or even consider a hostile takeover, shares of Monsanto rose a modest 0.5% for the day.

Generally speaking, when there’s such a large disparity between a company’s share price during a situation like this and the price at which they could be purchased, the market doesn’t think a deal is probable. This could be due to regulatory reasons but another possible reason is that the market doesn’t think the potential acquirer can (or is willing to) afford a transaction at an attractive price.

Beyond this, I believe Bayer backed itself into a corner when it stated that synergies, by the end of year three following the acquisition, would come out to $ 1.5 billion per year. While this is possible, it gives Monsanto the ability to demand more for the business because of the value Bayer believes an acquisition can bring.

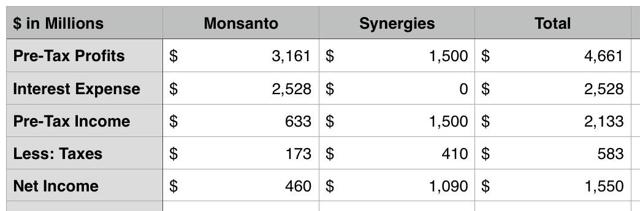

Take, for instance, the table below, which shows (using 2015’s financial data for Monsanto) what Monsanto’s earnings would be with debt of $ 49.73 billion (the amount that will be the difference between the value of shares issued and the total enterprise value of the company, pursuant to Bayer’s proposed capital structure from the time the deal was announced) and an interest rate of 5.1% (Bayer’s estimated weighted-average interest rate). In a nutshell, Monsanto without synergies would generate income, after interest and taxes, of just $ 460 million per year. With estimated synergies, however, we are looking at a whopping $ 1.55 billion in net income each year.

*Table Created by Author

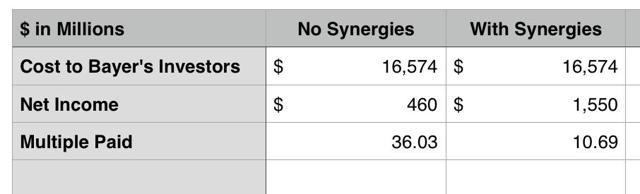

Though this is a nice amount of cash per year, if you make the assumption that debt is just rolled over forever while the true cost to shareholders, after interest, is what is issued in the form of equity, Bayer is now paying 36 times earnings for Monsanto. However, if Bayer can realize its synergies entirely, then that would result in a multiple of only 10.7 times earnings for the business, which is actually quite attractive. The differences can be seen in the table below.

*Table Created by Author

This creates an issue for Bayer if Monsanto wants to push for greater value. On the one hand, if Bayer can realize all or even most of its synergies, then acquiring Monsanto at a price even higher than its current price is perfectly fine. On the other hand, though, the deal becomes extremely pricey if none of the synergies are achieved. This creates performance risk for the executives at Bayer and also gives Monsanto the ability to come back and say, “gimme more” since if Bayer is so confident in its abilities, then it should still be happy at a higher price than shares are going for right now.

Takeaway

Based on the data provided, I think that a deal at these levels is not terribly likely and if Bayer wants a transaction to go through then it will need to offer a lot more or will have to wage a war with Monsanto to get it. Certainly, with the news release earlier on the 5th where it was revealed that Bayer may even consider a hostile bid, it’s likely that (even if it’s false) Monsanto will feel threatened as opposed to being equal partners in a constructive dialogue. This makes an agreement between the two less likely in my opinion even if they were to offer even higher prices, but does not necessarily mean a deal is out of the question.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in MON over the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

No comments:

Post a Comment